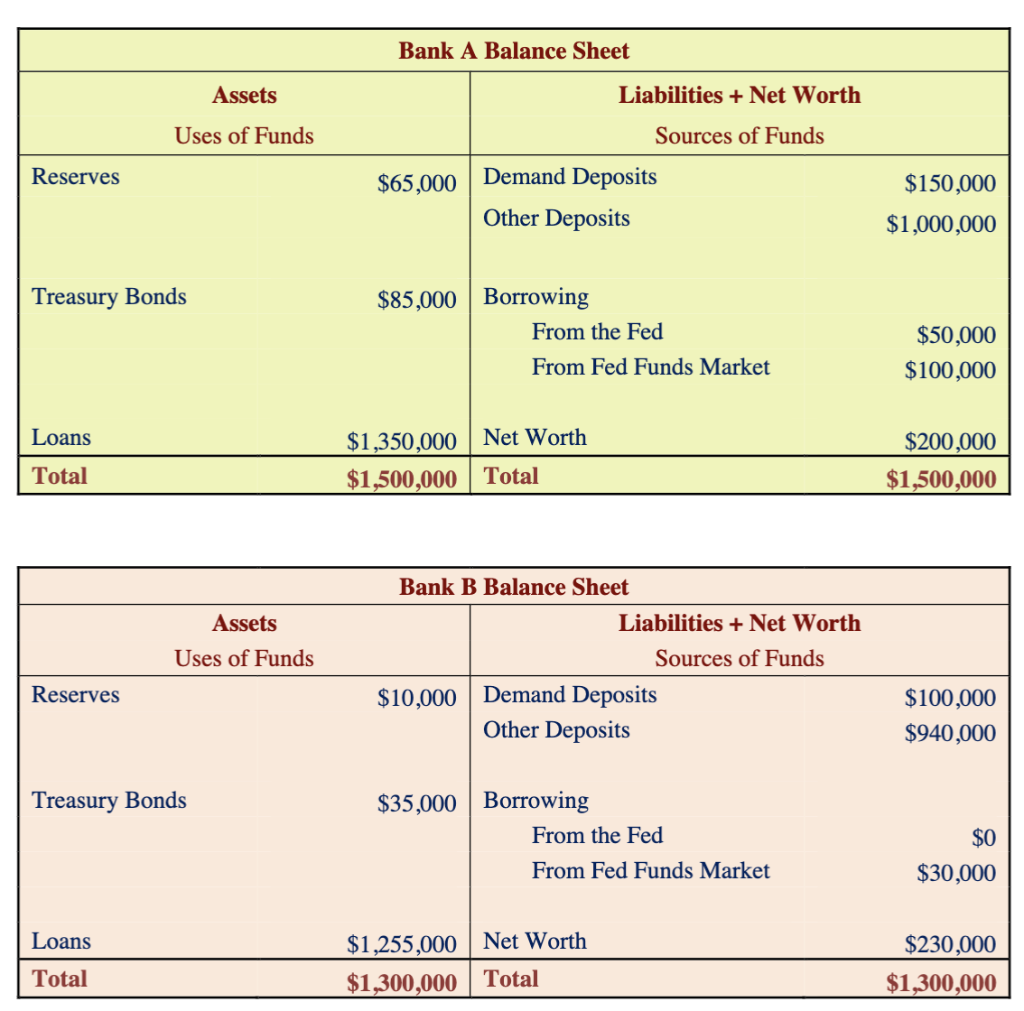

First Bank has cash reserves of $200,000, loans of $800,000, and deposits of $1,000,000. a. Prepare a balance sheet for the bank. b. If the bank maintains a reserve requirement of 15

Difference Between Bank Balance Sheet and Company Balance Sheet | Compare the Difference Between Similar Terms

Zero Shorts on X: "@denholmrobyn How will you repair $TSLA's insolvent balance sheet w -$1.855B neg working capital *including* $905M in customer deposits & $1.5B less (net) cash than A/R? Also, pls

What is Undeposited Funds on the Balance Sheet? - All-In-One Field Service Management Software by Aptora